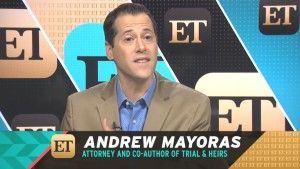

BRMM’s attorney Andy Mayoras, co-author of Trial and Heirs, appeared on Entertainment Tonight recently to speak about what will happen to Bobbi Kristina’s estate and Robin Williams’ estate.

What Happens Now to the Remainder of Whitney Houston’s Estate?

During a July 28th ET appearance, attorney Mayoras commented on how Bobbi Kristina’s estate, including the remainder of Whitney Houston’s estate that she was entitled to, would be disbursed. Mayoras discussed some considerations that would come into play. When singer icon Whitney Houston died, she left an estimated $20 million to her sole heir and daughter, Bobbi Kristina Brown. But, since Bobbi Kristina died before receiving most of it, and because Whitney Houston only had one child, most of the money will go back into Houston’s estate for the benefit of her mother and two brothers.

There are still many questions left to be answered. Neither Bobby Brown nor Nick Gordon, Bobbi Kristina’s long-time boyfriend, is likely to receive any of Whitney’s estate. Bobby Brown was named but was excluded later as a matter of law because of the divorce. Mayoras notes that considering most 21-year-olds are not thinking about creating wills, it is unlikely Bobbi Kristina had one.

It is also unknown how much Bobbi Kristina had already received out of Whitney Houston’s estate. Some speculate it could be up to $2 million. Questions such as how much of Bobbi Kristina’s inheritance was used to pay her medical care costs as well as how much Whitney Houston’s estate was truly worth are still up in the air.

One thing is for sure, though. Whitney Houston’s estate is far more complicated and messy than it would have been if she had done better estate planning.

Robin Williams’ Family Still Fighting Over His Estate

During an August 10th ET appearance, Andy Mayoras discussed the court battle between Robin Williams’ children and his widow, Susan Schneider Williams. One year after Robin Williams passed away, his family is still fighting in court about his estate, contrary to what Williams would have wanted. The biggest issue is how much of the estate will go into trust for the benefit of Williams’ widow, Susan Schneider Williams, to care for her and allow her to remain in the family home.

The other issue remaining is the division of a few remaining items of sentimental value. Williams’ trusts spelled out how his personal items were to be divided between his children and his widow, but his widow asked the court to interpret certain trust language in a way that would benefit her. This led to a debate over who should receive what. While the competing heirs already settled more of the disputed items, a few remain up in the air.

Experienced Estate Planning Is a Must — Plan Early and Smart

The Whitney Houston and Robin Williams Estates both highlight how important it is to do the proper estate planning, including thorough and updated wills and trusts. While Whitney Houston relied on only a will — which she failed to update for almost 20 years before she died — Robin Williams had a series of well-drafted trusts. Even though both have seen family feuding in court after they died, the magnitude of the problems facing Bobbi Kristina and other Houston family members make the spat between Williams’ heirs minor in comparison.

The better the estate planning, the less likely that drawn-out probate battles will follow. Of course, sometimes even the best planning cannot completely eliminate a fight — which is when having an experienced probate litigation attorney on your side is critical.

Whether you need an estate planning attorney to help avoid a fight, or a probate litigation attorney to guide you through a battle, the key is experience — and BRMM lawyers are among the most experienced and successful estate and probate attorneys in the State of Michigan.

BRMM probate litigation and estate planning attorneys are here to prevent problems and solve your estate and trust issues. Contact our Michigan probate litigation and estate planning offices at (248) 213-9514 or fill out our online form for a free consultation today.